Wealth vs. Riches: Understanding the Difference

At first glance, wealth and riches may sound like interchangeable words — just two shiny labels slapped on a pile of money. But dig deeper, and you’ll find they represent two very different philosophies about money, security, and life itself.

In a world where financial headlines often chase who’s richest this week, it's worth stepping back and asking: What’s the difference between being rich and being truly wealthy?

Let’s unpack the distinction — not with vague metaphors, but with real-world logic, historical context, and practical examples that apply whether you live in New York, Sydney, or Toronto.

💰 Riches: Flashy, Fast, and Often Fleeting

To be rich is to have access to a lot of money or material assets at a given moment. Think six-figure salaries, luxury homes, exotic cars, and the latest tech gadgets.

But here's the kicker: riches can disappear.

Being rich often comes with:

High income, high expenses: A person earning $500,000 a year might still live paycheck to paycheck if their lifestyle scales just as quickly.

Debt-fueled lifestyles: In countries like the U.S., household consumer debt has exceeded $17 trillion (Federal Reserve, 2024), much of it tied to people trying to “live rich” rather than be wealthy.

Lack of financial resilience: Without savings, passive income, or long-term planning, a single crisis — like job loss or illness — can topple the rich faster than expected.

In short: riches are visible, but often vulnerable.

🧱 Wealth: Durable, Quiet, and Strategic

Wealth, on the other hand, is not just what you earn, but what you keep and how it grows. It’s the foundation that continues to support your life — even when income stops.

True wealth includes:

Assets that generate passive income: rental properties, dividend stocks, businesses.

Liquidity and emergency savings: enough to handle months (or years) of uncertainty.

Time freedom: wealthy people often own their time — they aren’t trading every hour for dollars.

Generational planning: trusts, wills, and education funds that outlive a single person’s career.

In Australia, for example, the government’s encouragement of superannuation contributions is a long-term wealth strategy. In Canada, Tax-Free Savings Accounts (TFSAs) and RRSPs offer structured paths to build wealth without increasing tax burdens.

🔍 Real-World Examples

Example 1: The High-Income Doctor

Dr. Smith earns $400,000 a year as a specialist in California. She drives a Tesla, owns a modern home with a mortgage, and vacations in Europe twice a year.

But her student loans are still unpaid, she has minimal investments, and her emergency fund covers just one month of expenses. If her health fails or her practice slows down, she’ll be under pressure quickly.

Dr. Smith is rich — not wealthy.

Example 2: The Quiet Retiree

Mr. Chan, living in Vancouver, worked as a teacher for 35 years. He invested modestly into his pension, built up real estate equity, and contributes regularly to a TFSA. Now in his early 70s, he owns two rental units and lives comfortably off income that doesn't rely on work.

Mr. Chan is wealthy — even if he never looked “rich.”

🧠 The Psychology of Wealth

This isn’t just a numbers game — it’s also about mindset.

Rich thinking chases appearance: “I want others to know I’ve made it.”

Wealth thinking values security: “I want to ensure my family is okay — with or without me.”

Surveys by Fidelity (2023) found that 72% of millionaires in North America describe themselves as “financially secure, not flashy.” Many drive used cars, avoid conspicuous spending, and prioritize investment over indulgence.

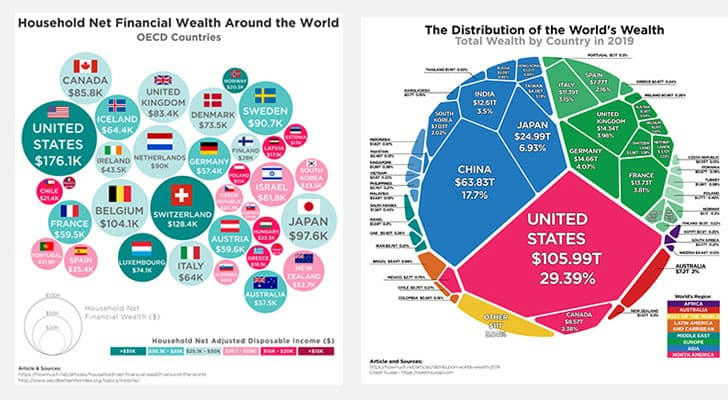

📈 Wealth Across Countries

| Country | Riches Culture (Short-Term) | Wealth Culture (Long-Term) |

|---|---|---|

| 🇺🇸 USA | High salaries, stock-based bonuses | 401(k), real estate, business equity |

| 🇨🇦 Canada | Strong income, high consumer debt | TFSAs, RRSPs, pension-focused planning |

| 🇦🇺 Australia | Dual-income, high property values | Superannuation, negative gearing on investments |

Observation: In all three countries, tools exist for people to build real wealth — but they’re often overshadowed by the pursuit of short-term riches.

🧮 How to Shift from Rich to Wealthy

Whether you're just starting out or already earning well, here are five practical steps:

Track net worth monthly — not just income or spending.

Invest consistently — don’t time the market; use automatic contributions.

Build an emergency fund — aim for 6–12 months of essential expenses.

Avoid lifestyle inflation — increase investing, not just spending, with each raise.

Own assets that grow — rental property, ETFs, index funds, or your own business.

🎯 Final Thought: Quiet Success Lasts Longer

Being rich might get you attention. But being wealthy gives you control.

Control over your time. Control over your choices. And most importantly, control over your future — and your family's future.

In a world obsessed with appearances, learning to value sustainable wealth over fleeting riches might be the smartest financial move you’ll ever make.