Overcoming FOMO: Sticking to a Wealth-Building Plan

In an era dominated by social media and instant access to global markets, it's easy to feel like you're falling behind. Friends are investing in the latest cryptocurrency, influencers are flashing luxury lifestyles, and market headlines shout about missed opportunities. This overwhelming Fear of Missing Out (FOMO) can create an illusion that wealth is only attainable through high-risk, high-reward moves.

But the truth is far less dramatic: sustainable wealth is built through consistent planning, disciplined investing, and emotional resilience. In this article, we’ll explore how FOMO impacts financial behavior, and more importantly, how you can overcome it by sticking to a personalized wealth-building strategy rooted in evidence, not emotion.

🔍 What Is FOMO and Why Is It Dangerous in Finance?

FOMO in financial decision-making refers to the anxiety that others are profiting while you're not. This psychological phenomenon can lead to:

Impulsive investment decisions without due diligence

Deviation from long-term plans in pursuit of short-term gains

Increased financial stress and eventual regret

According to a 2022 Charles Schwab Financial Literacy Survey, 42% of Gen Z and millennial investors admitted to making investment decisions based on social media posts—often to their financial detriment. These decisions are not grounded in fundamentals but driven by fear of lagging behind peers.

🚫 The Real Cost of Chasing Market Hype

Jumping from one trendy asset to another—whether it's meme stocks, NFTs, or the latest AI startup—rarely produces lasting results. Data from JPMorgan Asset Management shows that investors who try to time the market by reacting to news or trends consistently underperform those who simply stay invested over time.

A few key dangers include:

Buying high, selling low: Entering markets at peak hype and exiting during corrections

Lack of diversification: Overexposure to volatile assets

Neglecting long-term financial goals

In contrast, a disciplined approach grounded in research and tailored to your individual goals offers stability and compounding returns over time.

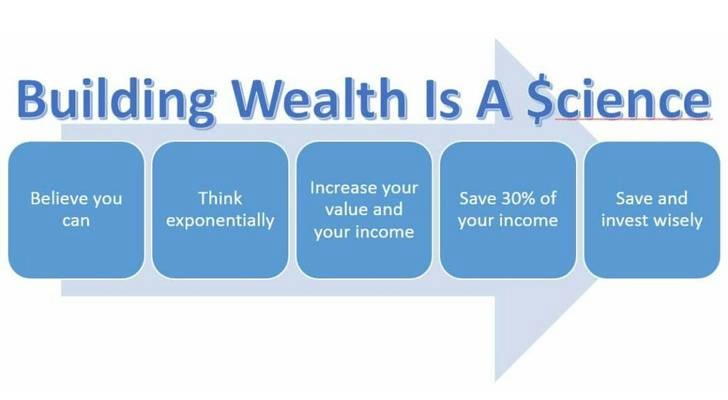

🧭 Building a Resilient Wealth Strategy

The antidote to FOMO is a well-structured, goal-oriented financial plan. It helps you focus on what truly matters and filters out the noise.

🔹 1. Define Your Financial Vision

Start by identifying what wealth means to you. Is it early retirement? Homeownership? Financial independence? Travel? Your definition will influence your risk tolerance, investment horizon, and asset allocation.

🔹 2. Establish a Budget and Emergency Fund

Before investing, ensure you have control over your day-to-day finances.

Use budgeting frameworks like the 50/30/20 rule or zero-based budgeting to allocate resources effectively.

Build an emergency fund covering 3–6 months of expenses to avoid liquidating investments prematurely during financial emergencies.

🔹 3. Invest with Purpose, Not Emotion

Regular investing—through strategies like dollar-cost averaging—helps reduce the emotional swings associated with market volatility.

Strong, evidence-based options include:

Index funds and ETFs: Low-fee, diversified, and historically strong performers.

Retirement accounts: 401(k), IRA, or Roth IRA accounts with tax advantages.

Real estate or REITs: Tangible or passive income-generating assets.

Avoid the temptation to chase high-risk assets without understanding their fundamentals or long-term potential.

🔁 Automate Your Wealth Journey

Automation reduces the cognitive load of financial decisions and reinforces consistency.

Set up automatic transfers to savings and investment accounts.

Use robo-advisors or goal-based platforms to manage portfolios aligned with your risk tolerance.

This hands-off approach helps avoid reactive decisions influenced by market swings or peer pressure.

🧠 Train Your Mind to Resist FOMO

The battle isn’t just financial—it’s psychological. FOMO feeds off our emotions. To resist it:

🔸 Limit Comparison Triggers

Unfollow social media accounts that promote unrealistic wealth standards or hype-driven investing. Studies show frequent exposure to financial boasting online can distort your perception of “normal” success.

🔸 Use a Cooling-Off Period

Before making any unscheduled investment, take 72 hours to reflect. Ask:

Does this align with my financial plan?

What are the risks if this goes wrong?

Am I acting based on fear or facts?

🔸 Celebrate Your Progress

Use tools like net worth trackers or personal finance dashboards to visualize how far you’ve come. Progress might feel slow, but consistency over time yields exponential results.

📈 The Power of Long-Term Compounding

Consider this: investing just $500/month in a low-cost S&P 500 index fund, with a historical average annual return of 8%, leads to:

10 years: ~$91,000

20 years: ~$247,000

30 years: $611,000+

That’s without chasing trends, timing the market, or taking huge risks. It’s the magic of compound interest—and it rewards patience, not panic.

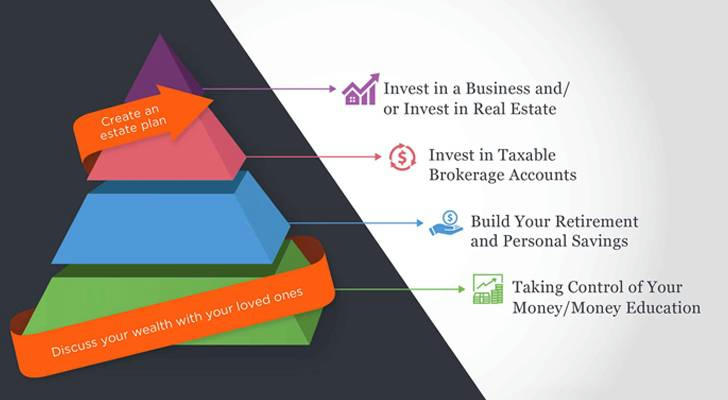

🛡️ Don’t Just Grow—Protect Your Wealth

A smart wealth strategy also includes:

Insurance: Health, disability, and property insurance to mitigate risks.

Asset allocation: Diversifying across asset classes to balance risk and return.

Debt management: Paying off high-interest liabilities before aggressive investing.

Wealth building is as much about defense as it is about growth.

✨ A Quiet Path to Financial Freedom

True wealth isn’t always loud. It’s not trending hashtags or flashy screenshots. It’s:

Financial peace of mind

Freedom to make life choices without money being the limiting factor

A legacy of security for your family

By sticking to your plan and tuning out distractions, you’re not missing out—you’re building something far more meaningful.

✅ Summary: Turn Down the Noise, Turn Up the Discipline

| 🔑 Step | 💼 Action |

|---|---|

| 🎯 Set Your Goals | Clarify what you’re investing for |

| 💰 Build Foundations | Budget wisely and maintain an emergency fund |

| 📊 Invest Consistently | Use dollar-cost averaging and diversified portfolios |

| 🔄 Automate Decisions | Remove emotion from routine investing |

| 🧘 Stay Focused | Review quarterly and block out hype-driven distractions |

Financial freedom isn’t built by chasing the crowd.

It’s earned by trusting your plan—day in, day out.