Why Your Credit Score Matters More Than You Think

Your credit score might seem like just another number in your financial life, but its influence reaches far beyond credit card applications. In fact, your credit score can affect your ability to rent an apartment, buy a car, or even qualify for certain jobs. While many people understand the basics of credit, fewer realize just how far-reaching its impact can be.

In the United States, credit scores are used by lenders, landlords, insurance companies, and employers to evaluate your financial trustworthiness. A strong score can save you thousands of dollars over time, while a weak score can limit your options significantly. This article will break down how credit scores work, why they matter, and what you can do to build or improve yours.

🔎 What Your Credit Score Really Means

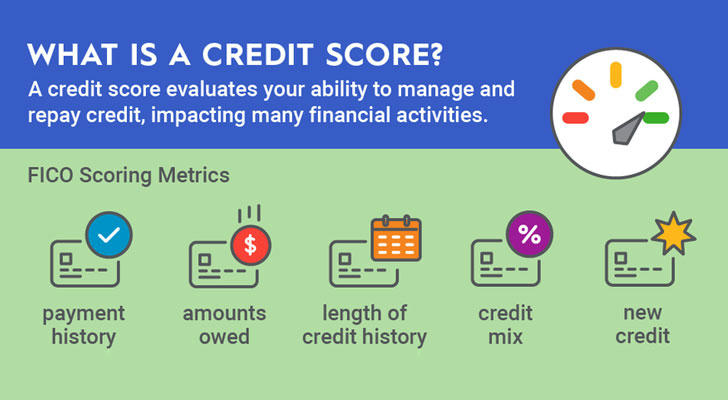

A credit score is a three-digit number, usually ranging between 300 and 850, that summarizes your creditworthiness based on your financial history. In the U.S., most credit scores are calculated using the FICO or VantageScore models.

The key factors affecting your credit score include:

Payment History (35%): Whether you’ve paid your credit accounts on time.

Credit Utilization (30%): The ratio between your credit card balances and your credit limits.

Length of Credit History (15%): How long your credit accounts have been active.

Types of Credit (10%): A mix of credit cards, loans, and other accounts.

New Credit (10%): How often you apply for new credit.

A higher score means you’re seen as a lower-risk borrower. According to Experian, one of the three major credit bureaus in the U.S., the average American credit score in 2024 was 716, which falls in the “Good” range.

| Score Range | Rating | Likely Impact |

|---|---|---|

| 800–850 | Excellent | Best access to credit and lowest interest rates |

| 740–799 | Very Good | Strong approval chances and favorable terms |

| 670–739 | Good | Generally acceptable but less competitive |

| 580–669 | Fair | Higher risk; more restrictions or costs |

| Below 580 | Poor | Limited credit options; possible rejections |

Why Your Credit Score Matters in Everyday Life

Credit scores are used for far more than just getting a credit card or loan. Here’s how your score may affect different areas of your life:

1. Car Loans and Mortgages

A higher score generally leads to lower interest rates. For example, data from the Federal Reserve shows that borrowers with scores above 760 often receive interest rates 1%–3% lower than those with scores below 660. Over the life of a mortgage or auto loan, that difference could result in thousands of dollars saved.

2. Renting an Apartment

Many landlords check your credit score before approving a lease. A lower score may require a co-signer, a larger security deposit, or even lead to rejection.

Real example:

When Rachel, a graduate student in Colorado, applied for an apartment in 2023, her score of 580 led the landlord to ask for two months’ rent upfront. After she improved her score to 700 over a year by paying down credit cards and making on-time payments, she was able to rent her next apartment without additional conditions.

3. Utilities and Insurance

Some utility companies and insurance providers use your credit report to decide whether to require a deposit or offer certain rates. A low score might mean higher premiums or upfront payments.

4. Employment Opportunities

In sensitive industries like finance or government, employers may review credit reports (with permission) to assess an applicant’s reliability. While they don’t see the score itself, poor credit history may still raise concerns.

📈 How to Boost Your Credit Score

Improving your credit score is not an overnight process, but steady, responsible actions can make a big difference over time. Here are practical steps:

1. Pay On Time, Every Time

Set reminders or enable auto-pay to ensure you never miss a due date. Payment history is the single most important factor.

2. Reduce Credit Card Balances

Keep your credit utilization ratio under 30%—meaning if you have a $5,000 limit, try to stay below $1,500 in balance. Lower is better.

Real example: James, a recent college graduate in North Carolina, was using 90% of his available credit. After working part-time to pay down his balances over 8 months, his score rose from 590 to 720.

3. Keep Old Accounts Open

Length of credit history matters. If you close your oldest account, it may reduce your score, especially if it’s your longest-standing credit line.

4. Limit Hard Inquiries

Too many credit applications in a short time can lower your score. Try to space out new credit requests and only apply when needed.

5. Check Your Credit Report for Errors

You’re entitled to a free credit report from each of the three bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com. Look for incorrect balances, accounts you don’t recognize, or outdated information.

What If You Have No Credit History?

If you’re new to credit or have a thin file, consider the following:

Apply for a secured credit card, which requires a refundable deposit and reports to credit bureaus.

Become an authorized user on a family member’s or friend’s card (with their consent).

Use rent or utility reporting services to include consistent monthly payments in your credit profile.

Over time, even small actions can help establish a credit history and build a positive score.

✅ Conclusion

Your credit score plays a vital role in your financial life. It affects the cost of borrowing, your ability to secure housing, and even your job prospects in some cases. The good news is that you’re not stuck with your current score forever. With informed decisions and responsible habits, you can build, maintain, or recover your credit health.

Start by checking your credit report, understanding what influences your score, and committing to consistent, on-time payments. Your future self will thank you—and so will your bank account.