Credit Utilization: The 30% Rule and Why It Matters

Your credit score is like a financial report card—it tells lenders how responsible you are with money. One of the biggest factors affecting your score? Credit utilization, or how much of your available credit you’re using. Financial experts often cite the "30% rule"—keeping your credit utilization below 30%—as a key strategy for maintaining a healthy score. But why does this rule exist, and what happens if you ignore it?

In this article, we’ll break down:

What credit utilization is and how it’s calculated

Why the 30% rule matters (and whether you should aim even lower)

Real-life consequences of high credit utilization

How to improve your credit utilization strategically

Plus, we’ll share a true story of how one person’s credit score dropped 100 points in a month—just by maxing out a single card.

1. What Is Credit Utilization?

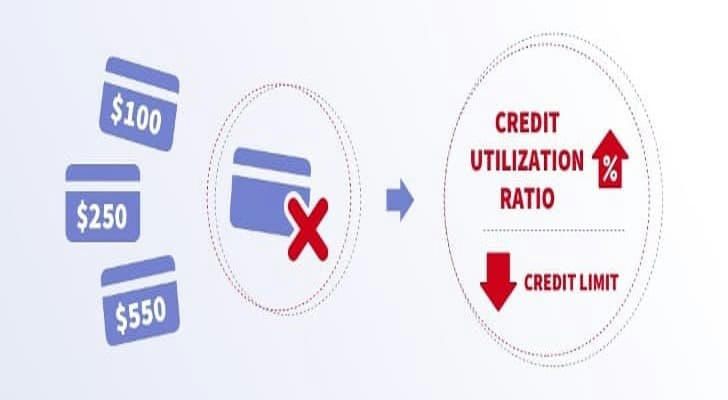

Credit utilization is the percentage of your available credit that you’re currently using. It’s calculated both per card and across all your cards.

Example:

You have two credit cards:

Card A: $5,000 limit, $1,500 balance

Card B: $3,000 limit, $500 balance

Per-card utilization:

Card A: $1,500 / $5,000 = 30%

Card B: $500 / $3,000 = 16.7%

Overall utilization:

Total balance: $2,000

Total limit: $8,000

Utilization: 25%

Credit scoring models (like FICO and VantageScore) consider both individual and overall utilization, but keeping each card below 30% is ideal.

2. Why the 30% Rule Exists

Credit bureaus see high utilization as a red flag—it suggests you might be overextended financially. While no utilization (0%) can also hurt your score (since lenders want to see responsible usage), maxing out cards is far worse.

The Impact on Your Credit Score

Low utilization (1%-9%) → Best for scoring (some experts argue for staying under 10%)

Moderate utilization (10%-30%) → Still good, but not optimal

High utilization (31%-100%) → Begins to damage your score

What Happens If You Exceed 30%?

Short-term: Your score may drop immediately—even if you pay it off next month.

Long-term: Consistently high utilization makes you look risky to lenders, leading to:

Higher interest rates on loans

Lower credit limits

Rejections for new credit

3. A Real-Life Credit Utilization Mistake

Meet Sarah (Name Changed for Privacy)

Sarah, a marketing professional in Chicago, had a 780 FICO score—excellent by most standards. She used her credit card for everyday expenses but always paid the full balance on time.

Then, one month, she booked a $4,500 vacation on her card (which had a $5,000 limit). She planned to pay it off in two months.

What happened next?

Her credit utilization jumped from 8% to 90% on that card.

Her overall utilization went from 12% to 48%.

Her credit score dropped 102 points in 30 days.

Even though she paid the balance in full later, her score took three months to fully recover.

Lesson: High utilization can hurt your score fast, even if you’re not missing payments.

4.How to Keep Your Utilization Low

Pay Early (Before the Statement Closes)

Credit card issuers report balances to bureaus once per month (usually on the statement closing date). If you pay down balances before that date, your reported utilization stays low.

Ask for a Credit Limit Increase

A higher limit = lower utilization (if spending stays the same). Just don’t spend more afterward!

Spread Purchases Across Multiple Cards

Instead of maxing out one card, divide spending to keep each card’s utilization low.

Use a Personal Loan for Large Purchases

If you need to finance a big expense, a fixed-rate personal loan (which doesn’t affect utilization) may be better than a credit card.

5.Final Thoughts: Should You Aim for 10% Instead of 30%?

While 30% is the widely accepted threshold, the best scores often come from utilization below 10%. If you’re working toward:

A mortgage

A car loan

A premium credit card

…then keeping utilization as low as possible will help.

Key Takeaway: Credit utilization is a short-term factor—it resets every month. But if you let it spiral, the damage can linger. Monitor it closely, and your credit score will thank you.

Your Next Steps

Check your credit card balances today.

Set up balance alerts to avoid surprises.

Pay strategically—not just on the due date, but before the statement closes.

By mastering the 30% rule, you’ll keep your credit score strong and your financial options open.