Credit Cards vs. Debit Cards: Making the Most of Both 💳

Credit cards and debit cards are two of the most commonly used financial tools in the United States. They are easy to carry, convenient for everyday purchases, and accepted almost everywhere. Yet, many people don’t fully understand how they differ—or how to use them to their advantage.

Choosing between a credit card and a debit card can impact more than just your bank balance. It can affect your credit score, your budget, and even your fraud protection. According to the Consumer Financial Protection Bureau (CFPB), federal law offers stronger fraud protection for credit cards than for debit cards. This makes it important to know when to use each card and why.

This article will walk you through the key differences between credit cards and debit cards, offer real-life examples, and provide practical tips to help you make the most of both.

🔍 Understanding the Differences

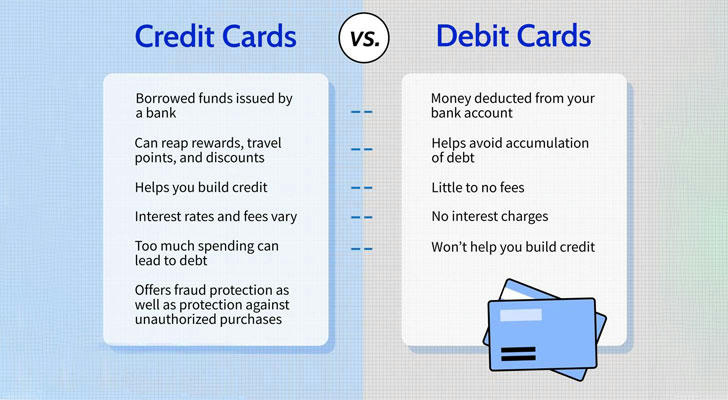

Although they look almost identical, credit and debit cards function differently:

Credit cards allow you to borrow money from a lender up to a certain limit. You receive a monthly bill and are expected to pay it off—either partially or in full.

Debit cards pull funds directly from your checking account. You are limited to the amount of money you have in your account at the time of purchase.

Here’s a comparison of key features:

| Feature | Credit Card | Debit Card |

|---|---|---|

| Source of Funds | Borrowed from credit line | Your own bank account |

| Credit Building | Yes | No |

| Fraud Protection | Strong (federal protection) | Limited (bank-specific policies) |

| Interest Charges | Possible if balance unpaid | None |

| Budgeting Control | Can overspend | Encourages spending discipline |

| Rewards | Often available | Rarely offered |

🎯 When to Use a Credit Card

Credit cards, when used wisely, offer multiple advantages:

Build and improve your credit score: Payment history is the biggest factor in credit scoring. Paying your credit card bill on time each month helps build a positive credit profile.

Earn rewards: Many cards offer cashback, travel points, or other perks, especially for everyday categories like groceries, gas, or dining.

Enjoy stronger fraud protection: Under the Fair Credit Billing Act (FCBA), liability for unauthorized use is capped at $50, and most major credit card issuers offer zero liability policies.

Real example:

Emma, a 29-year-old teacher in California, uses her credit card for planned monthly expenses such as utilities, internet, and groceries. She pays the balance in full each month and earns around $150 annually in cashback rewards. Her responsible use also improved her credit score from 675 to 740 over two years, qualifying her for a better rate on her car loan.

🧾 When to Use a Debit Card

Debit cards are ideal for those who want to stay on top of their budgets and avoid taking on debt. They are connected to your checking account and usually reflect transactions instantly.

Stay within budget: Since you can only spend what you have, debit cards are great for financial discipline.

Avoid interest and debt: No borrowing means no monthly payments or risk of accruing interest.

Better for small, everyday purchases: Useful for coffee shops, convenience stores, or paying a friend back through a payment app.

Real example:

Alex, a university student in Ohio, uses his debit card for day-to-day expenses. He limits his spending to $250 per week and checks his balance daily. By using his debit card instead of credit, he has avoided late fees, interest charges, and has stayed on top of his finances while building a savings cushion.

Which Card Should You Use and When?

In reality, you don’t need to choose one card over the other. The smartest financial strategy is often using both—depending on the situation.

Use a credit card when:

You’re making large purchases or recurring payments.

You want to build or improve your credit history.

You’re booking hotels, flights, or rental cars that require a credit hold.

You're taking advantage of points, cashback, or travel benefits.

Use a debit card when:

You want to limit your spending and stick to a budget.

You're making small, everyday purchases.

You’re withdrawing cash from an ATM.

You prefer not to carry a balance or risk accruing interest.

Common Mistakes to Avoid

Even with the best intentions, it’s easy to misuse either type of card. Some common pitfalls include:

Carrying a high balance on credit cards: This increases your credit utilization ratio and lowers your credit score.

Using a debit card online without checking your account: Some online purchases offer less protection and can drain your account quickly in case of fraud.

Ignoring your statements: Whether it's credit or debit, monitoring your transactions is key to spotting errors or fraud.

Tips for Responsible Use

Always pay your credit card balance in full to avoid interest charges.

Set up alerts for both types of cards so you know when purchases are made.

Check your credit report regularly through free services like AnnualCreditReport.com.

Don’t close old credit card accounts unless necessary, as they help maintain a longer credit history.

Avoid using credit cards for impulse buys or expenses you can’t afford to pay off immediately.

✅ Conclusion

Both credit and debit cards can be valuable tools in managing your finances, but only when used with intention. Credit cards can help you build credit and earn rewards, while debit cards promote budgeting and spending within your means.

By understanding when to use each, you gain greater control over your money and avoid common financial pitfalls. Whether you're just starting out on your financial journey or looking to improve your habits, knowing how to balance credit and debit is a step toward smarter financial living.