Budgeting for Beginners: Turn Numbers Into Freedom

Let’s face it: “budgeting” doesn’t sound sexy. It conjures images of spreadsheets, sacrifice, and skipping your morning Starbucks. But here’s the truth they don’t teach you in school: budgeting isn’t about restriction—it’s about freedom.

Freedom to say yes to the vacation.

Freedom to pay off debt.

Freedom to quit the job you hate, start the side hustle you love, or finally stop living paycheck to paycheck.

And the best part? You don’t need to be good at math or live on ramen noodles to start.

🧠 *Why Budgeting Feels Hard (But Isn’t)

Americans live in a culture of easy spending. One-click Amazon purchases, DoorDash at 2 a.m., $9 streaming subscriptions that add up to $90. According to a 2024 NerdWallet study, over 65% of Americans don’t use a formal budget—and most say it’s because “it feels overwhelming.”

But budgeting isn’t about micromanaging every cent. It’s about telling your money where to go instead of wondering where it went. Think of it like GPS for your finances. You wouldn’t start a road trip without directions—why treat your paycheck any differently?

💡 The Mindset Shift: Budget = Choice

Forget the word “budget” for a second and replace it with “spending plan.”

Doesn’t that feel better?

A spending plan means you choose how to spend your money. You can absolutely have your latte—as long as you plan for it. Budgeting isn’t about cutting all the fun. It’s about cutting the unintended spending that’s quietly draining your bank account.

Ask yourself: If you don’t know where your money is going, how do you know it’s going somewhere you actually want?

📦 Step-by-Step: How to Build a Beginner Budget

You don’t need fancy tools to start budgeting. You just need a plan—and maybe a coffee. Here's how:

1. Know Your Income (The Real Number)

We’re not talking about your annual salary—look at your take-home pay after taxes, insurance, and 401(k) contributions. That’s what you can actually spend.

Example: If you make $60,000 a year, your monthly take-home might be closer to $3,800.

2. Track Where It’s Going

Before creating a budget, you need to know where your money currently goes. For 30 days, track everything. Apps like Mint, YNAB, or even a notes app on your phone can help.

You might be shocked:

$300 on takeout

$70 on random Target runs

$25 on forgotten subscriptions

Knowledge is power. This step reveals your habits—and your leaks.

3. Categorize Your Spending

Divide your expenses into needs, wants, and savings/debt.

| Category | Examples |

|---|---|

| Needs | Rent, groceries, utilities, transportation |

| Wants | Dining out, streaming, shopping |

| Savings/Debt | Emergency fund, credit cards, retirement |

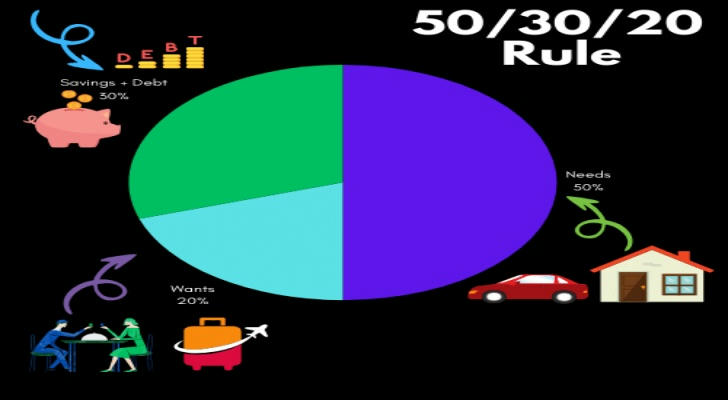

Try to follow the 50/30/20 rule as a starting point:

50% for needs

30% for wants

20% for savings/debt repayment

Don’t panic if your numbers aren’t perfect yet—the goal is awareness, not shame.

4. Set Realistic Goals

Do you want to:

Pay off your $5,000 credit card?

Save $1,000 for an emergency?

Go to Mexico next spring?

Great. Break it down. If you want to save $1,000 in 5 months, you’ll need to budget $200/month. When your money has a purpose, it’s easier to say no to things that don’t matter.

5. Use Cash for Problem Areas

If you overspend in categories like eating out or shopping, try the cash envelope method. Take out $100 at the start of the month, put it in an envelope labeled “Restaurants,” and when it’s gone—it’s gone. This works wonders because spending cash feels more real than swiping plastic.

6. Automate the Smart Stuff

Set up:

Automatic transfers to your savings every payday

Auto-pay for bills to avoid late fees

Debt snowball payments, where you knock out your smallest debt first

Automation removes willpower from the equation—which is a good thing. Set it and forget it (until you start seeing results).

🚧 Common Pitfalls to Avoid

Being too strict.

Budgeting isn’t punishment. Leave room for fun—or you’ll binge spend later.

Not adjusting.

Budgets aren’t set in stone. Life changes. Your budget should too.

Forgetting irregular expenses.

Car maintenance, holiday gifts, annual memberships—plan for these so they don’t blindside you.

💬 Final Thought

If you’ve ever said, “I make enough money… I just don’t know where it all goes,” you’re not alone.

The truth is: You don’t need more money—you need a plan.

Budgeting isn’t a chore. It’s an act of self-respect. It’s permission to dream, backed by a strategy to actually get there.

So grab a notebook, open a spreadsheet, or download a free app. Your budget isn’t just numbers on a screen—it’s a map to your freedom.