Life Insurance Choices That Actually Make Sense for You

Life insurance: two words that often trigger confusion, avoidance, or a vague feeling of "I'll deal with that later." Yet when life takes an unexpected turn, it's the quiet safety net that can mean financial stability for loved ones. The challenge isn’t whether to get life insurance — it’s knowing which kind makes sense for you.

This article breaks down the world of life insurance without the jargon or pressure. Whether you’re 25 or 65, single or raising a family, there’s a policy structure that can align with your life — not complicate it.

🧩 What Life Insurance Really Does

At its core, life insurance is a contract: you pay a premium, and in return, your designated beneficiaries receive a payout (called a death benefit) if you pass away during the coverage period.

But it’s not just about death. It’s about continuity:

Paying off mortgages so families aren’t forced to move.

Replacing lost income so children’s education plans stay on track.

Covering final expenses so loved ones aren't overwhelmed by sudden costs.

It’s financial planning with compassion at its core.

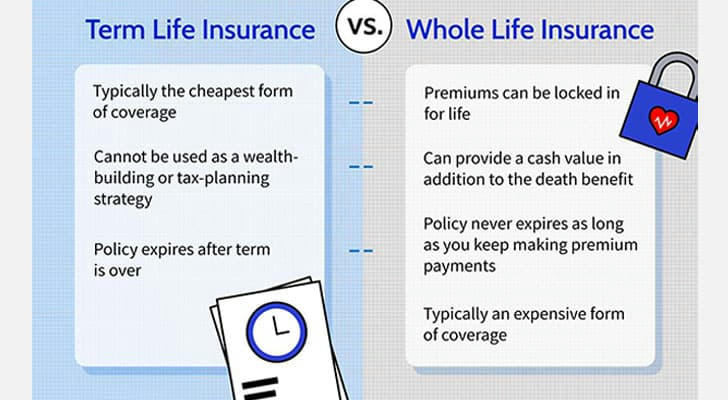

🧠 Term vs. Whole Life: What’s the Difference?

This is the first fork in the road for most people. There’s no one-size-fits-all answer, but here’s a breakdown that simplifies the choice.

🕒 Term Life Insurance

Covers you for a specific period (10, 20, or 30 years).

More affordable, especially when you’re young.

Ideal for temporary needs like income replacement or debt coverage.

🌳 Whole Life Insurance

Lasts your entire life (as long as premiums are paid).

Includes cash value accumulation.

Better suited for long-term planning, estate transfer, or lifelong dependents.

🌎 Policy Variations by Country

🇺🇸 United States

In the U.S., more than 52% of Americans reported having some form of life insurance coverage in 2023, according to LIMRA (Life Insurance and Market Research Association). However, nearly 41% of those said they were underinsured and would face financial hardship within six months if the household’s primary earner passed away.

Tax-free death benefits.

Employer plans often provide basic group term life.

Riders for critical illness, accidental death, and long-term care are common.

🇨🇦 Canada

According to the Canadian Life and Health Insurance Association (CLHIA), over 22 million Canadians own life insurance — that’s nearly 58% of the population. The average coverage per insured household is about CAD $423,000.

Term 10, 20, and 30 policies dominate the market.

Participating whole life policies may pay dividends.

Coverage is portable across provinces.

🇦🇺 Australia

In Australia, many people receive default life cover through superannuation. According to ASIC’s Moneysmart, nearly 70% of Australians have some insurance via their super fund, but the default amount is often insufficient, with the average cover only about 30% of what a family may actually need.

Life, TPD, and income protection often bundled in super.

Premiums may be tax-effective inside super.

Top-up policies recommended for parents, homeowners, and sole breadwinners.

💡 What Determines the Cost of a Policy?

Several factors affect pricing:

Age: Younger = cheaper.

Health: Lifestyle habits and medical history impact rates.

Policy type & duration: Longer terms and permanent policies cost more.

Country-specific underwriting rules: In Australia and Canada, some pre-existing conditions are handled differently than in the U.S.

🔍 Tailoring Life Insurance to Life Stages

| Stage of Life | Ideal Policy Type | Country-Specific Tip |

|---|---|---|

| Recent graduate | Term 10 or Term 20 | 🇨🇦 Look for policies with guaranteed convertibility |

| New parent | Term 30 | 🇺🇸 Consider child riders and accidental death add-ons |

| Mid-career professional | Term + Whole blend | 🇦🇺 Compare inside vs. outside super options |

| Retiree/estate planner | Whole Life or Universal Life | 🇺🇸 Permanent policies with tax-sheltered growth |

🧭 Practical Add-Ons That Matter

Some optional extras can make a policy more responsive to real-world risks:

Accelerated death benefit (U.S./Canada): Early payout if diagnosed with terminal illness.

TPD (Total & Permanent Disability) — common in Australia.

Waiver of premium: Coverage continues if you become disabled and can’t pay.

Guaranteed insurability: Add more coverage later without a new medical check.

🧮 How Much Coverage Do You Really Need?

Here’s a simplified starting point:

Coverage = (Annual Income × 10) + Debts – Assets

Also factor in location-based costs:

U.S. families often need to account for college tuition and medical bills.

Canadian residents may prioritize mortgage and education savings (RESPs).

Australians may consider gap coverage if relying on super insurance only.

🎯 Final Thought: It’s Personal — And It Should Be

Life insurance isn’t just a financial product — it’s a tool that reflects your values, your plans, and the people who matter most. In the U.S., Canada, or Australia, the core principle remains the same: prepare today so your family can thrive tomorrow.

Choosing a plan that truly makes sense starts with understanding your options, knowing how they function in your country, and adapting the solution to your stage in life.